NMLS # 1393730

Call Us! (682) 777-3950

NMLS # 2566884

Pre-Qualify Vs. Pre-Approval

Your Texas Mortgage Loan Officer

Here at Texas Elite Team, our primary objective is to provide our clients with a higher value, and smoother and more hassle-free transaction. With our years of experience we have learned to anticipate and problems solve common issues that arise during normal Real Estate and Mortgage transactions. Discover our approach and how we achieve the goals and surpass our competition.

Pre-Approval vs. Pre-Qualification for Homebuyers

For many prospective homebuyers, understanding the difference between mortgage pre-approval and pre-qualification is crucial. Both processes can help you gauge your readiness to purchase a home, but they serve different purposes and carry different weight in the eyes of sellers and real estate agents.

“If is wasn't for Tricia's expertise in negotiating, patience, problem solving and creative thinking skills this entitled buyer would have continued to demand more and more.”

Tricia had her hands full when dealing with me and the all cash buyer, simply put, he was by far the most difficult person I had ever dealt with in any real estate transaction. If is wasn't for Tricia's expertise in negotiating, patience, problem solving and creative thinking skills this entitled buyer would have continued to demand more and more. Tricia knew when to push back and more importantly protect me and put my best interests first. Her experience made this sell happen very quickly, it sold on the first day in a very difficult market.... she actually negotiated $10,000 over ask. I was taught years ago that experience is the best teacher....well look no further, Tricia has what it takes to get the job done no matter how difficult it may be. I am forever grateful to her for making my dream a reality.

~ G Green

What is Pre-Qualification

Pre-qualification is typically the first step in the mortgage process. It's a quick, simple way to get an estimate of how much you might be able to borrow.

Initial Estimate: A pre-qualification is an informal estimate of how much you might be able to borrow based on basic financial information like your income, debt, and assets. It does not involve a detailed credit check or document verification.

Self-Reported Information: The process is usually quick and based on the information you provide without the lender verifying it.

No Commitment: It gives you a general idea of your loan options but doesn’t guarantee loan approval or specific terms.

Key features of pre-qualification:

Based on self-reported financial information

May require only a "soft pull" credit check

Can often be done online or over the phone

Provides a general idea of your borrowing capacity

Typically takes less time than pre-approval

All Financial documents not required

Note: A "Soft Pull" Credit check is something Lenders can do to take a quick peek into your credit without the impact of an inquiry. However, once you decide to move forward with the Loan they will then need to pull the "Hard Pull" meaning it will result in an inquiry on your credit and usually only impacts your score by a couple of points. There is no way around the Hard Inquiry when you are trying to obtain a loan.

Pre-qualification is ideal for homebuyers who are in the early stages of their home search. It gives you a ballpark figure of what you might be able to afford, helping you narrow down your home search to properties within your potential price range

“Tricia wasn’t in this for just a, “quick sale.” Her knowledge, expertise and professionalism is unmatched..”

Tricia Madrid is a one-of-a-kind! Tricia went above and beyond with the amount of time she has spent in assuring my family find our, “forever home.” She listened to and addressed all of our needs and wants. Tricia wasn’t in this for just a, “quick sale.” Her knowledge, expertise and professionalism is unmatched. Choose to be represented by Mrs. Madrid, you will not regret for one second that you did. Trust the process and Tricia. If I could give 10 plus stars, I would. This agent deserves all the accolades and recognition. She is truly an outstanding agent. I’m blessed and fortunate to have had her by my side every step of the way. Thank you so much Tricia. Job beyond well done!

~ Daniela Vasquez

What is Pre-Approval

Pre-approval is a more rigorous process that results in a conditional commitment from a lender for a specific loan amount.

Detailed Review: A pre-approval involves a more in-depth look at your finances. The lender will review your credit score, verify your income, employment, and assets, and may require you to submit documents like tax returns and bank statements.

Stronger Commitment: With pre-approval, the lender provides a conditional commitment to lend you a specific amount, subject to final approval. It’s a more solid step in the home-buying process and signals to sellers that you are a serious and qualified buyer.

Credit Check: A credit check is required, and it is a stronger indicator of your ability to secure a loan.

Key features of pre-approval:

Requires detailed financial documentation (e.g., W-2s, bank statements, pay stubs)

Involves a thorough credit check

Provides a more accurate estimate of your borrowing capacity

Results in a pre-approval letter, typically valid for 90 days

Takes more time but carries more weight with sellers

Pre-approval is crucial when you're ready to make offers on homes. It shows sellers that you're a serious buyer with the financial backing to complete the purchase

In short, pre-qualification is a quick, informal estimate, while pre-approval is a more detailed, formal process that gives you greater certainty and credibility when making offers.

“Her commitment to ensuring my understanding and confidence in this process has made this journey both informative and rewarding.”

Tricia embodies qualities that truly stand out - her expertise, unwavering patience, and professionalism. As a first-time home buyer navigating uncharted territory, I found myself relatively inexperienced in the process. Tricia stepped in, dedicating her time to meticulously guide me through every aspect, ensuring I grasped the nuances involved. Her responsiveness was remarkable - whenever I expressed interest in a property, her swift reply of "I will get that set up!" was reassuring.

Her flexibility in accommodating viewing schedules and her constant availability for my inquiries made the journey smoother. Tricia didn't merely showcase homes; she delved into thorough explanations, shedding light on intricate details and potential risks associated with each property. Her transparency and honesty were invaluable, earning my deep appreciation.

Tricia's unwavering dedication to helping me discover the perfect home has been evident throughout our interactions. Her commitment to ensuring my understanding and confidence in this process has made this journey both informative and rewarding. I am positive that I will find my dream home with the help of Tricia!

La Tonya W – January 2024

Why Homebuyers Need a Prequalification Letter

A prequalification letter provides several advantages when beginning your home search:

Establishes Budget: Getting prequalified gives you a realistic estimate of how much you can afford to borrow, helping you focus your search on homes within your price range.

Demonstrates Seriousness: A prequalification letter shows sellers and real estate agents that you're a serious buyer who has taken initial steps toward securing financing.

Speeds Up the Process: By getting prequalified early, you'll be better prepared when you find a home you want to make an offer on.

Identifies Potential Issues: The prequalification process can uncover any credit or financial issues that might need to be addressed before applying for a mortgage

“She was very nice she went above and beyond working with me to get me a home that is within my needs”

She was very nice she went above and beyond working with me to get me a home that is within my needs and my children. I wanted to stayed with the HEB area and we look for about I lost count but she never gave up. Tricia is very kind and patience explaining being a homeowner since this was my first home

~ Josephine Dankwa

URGENT . . . PLEASE READ THIS ! ! !

Expedites the Loan Process

Promptly providing documentation helps keep the mortgage approval process moving forward efficiently. Delays in submitting paperwork can slow down underwriting and potentially jeopardize closing dates. By being responsive, buyers help ensure their loan stays on track.

Providing your documents to a lender is only the first step in the process. Once you provide the documents to the Loan officer, they hand it off to the processor to prepare for submission to underwriting. Then the underwriter determines if that documentation is sufficient to satisfy the condition OR if they need additional documentation from the buyer. Once they sign off on all conditions, the loan then goes to the Lender's closing Department where they prepare the loan package for the title company. When the Title company receives the documents, they must review and prepare the closing package for signing/closing.

Each step can take anywhere from hours to days depending on the current workload of each party. So it is crucial to get your documents to the Lender as quickly as possible so it doesn't delay the lender's ability to move things forward.

Also, depending on what the condition being requested is, it could impact the numbers of the transaction, which could result in a new updated closing disclosure being issued. This also means a mandatory waiting period between the issue date and closing.

Buyers should make every effort to get the documents to the Lender the same day of the request or as quickly as possible to avoid delays and complications in the closing process.

Demonstrates Seriousness

Quickly submitting requested documents shows lenders that you are a serious and motivated buyer.

This can work in your favor, as lenders may prioritize borrowers who are proactive and organized.

Allows Time to Address Issues

The sooner documents are submitted, the sooner potential issues can be identified and addressed.

If there are any discrepancies or additional information needed, having extra time allows buyers to resolve problems without delaying closing.

Maintains Preapproval Status

Preapproval letters typically have expiration dates.

Promptly providing updated documentation helps maintain your preapproval status, which is crucial when making offers on homes.

Competitive Advantage

In competitive real estate markets, having your financing in order gives you an edge.

Sellers are more likely to consider offers from buyers who can demonstrate they are prepared and financially qualified.

Prevents Last-Minute Stress

Gathering and submitting documents early in the process helps avoid the stress of scrambling to find paperwork at the last minute.

This allows buyers to focus on other aspects of the home purchase. By being proactive and submitting requested documents promptly, homebuyers can help ensure a smoother, more efficient mortgage approval process and increase their chances of a successful home purchase.

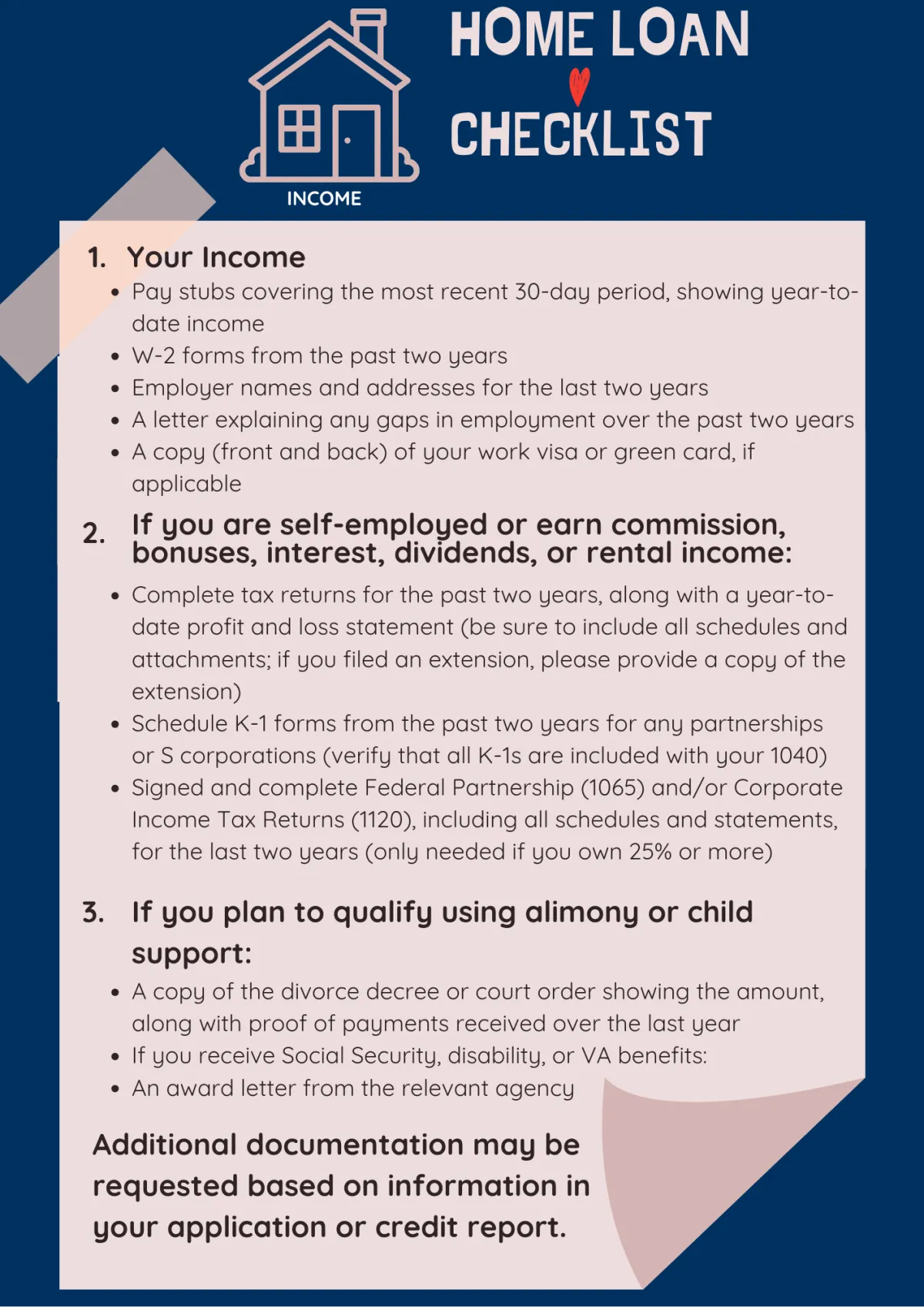

Now that you know the Urgency of getting documents to the Lender....

Let's look at what documents may be needed.

"We will use her again, and I recommend you do too!"

Sold a Single Family home in 2021 in Southwest, Arlington, TX.

Some believe a realtor who is calm, laid back, and a bit quiet isn't going to be that aggressive and knowledge when the process of selling your home begins. Meet Tricia, a calm, laid back, a bit quiet GO GETTER, realtor! She represented our home, and in a

'offer in a minute' market, she had it under control. Being new here, and

somewhat overwhelmed, she came to the plate, and batted us all home, with a win

for both the buyer and (we), the seller. We will use her again, and I recommend

you do too!

3/30/2022 - Charles MacBride

"she actually negotiated $10,000 over ask."

Tricia had her hands full when dealing with me and the all cash buyer, simply put, he was by far the most difficult person I had ever dealt with in any real estate transaction. If is wasn't for Tricia's expertise in negotiating, patience, problem solving and creative thinking skills this entitled buyer would have continued to demand more and more. Tricia knew when to push back and more importantly protect me and put my best interest first. Her experience made this sell happen very quickly, it sold on the first day in a very difficult market.... she actually negotiated $10,000 over ask. I was taught years ago that experience is the best teacher....well look no further, Tricia has what it

takes to get the job done no matter how difficult it may be. I am forever grateful to her for making my dream a reality.

ggreen702

Serving DFW Metroplex

TEXAS ELITE TEAM

Texas Elite Team

4314 Blossom Valley Lane

Richmond, TX 77469

Phone: (682) 777-3950

Follow Us

Call Us!

(682) 777-3950

MLS Information Deemed Reliable But Not Guaranteed. This information is being provided by the NTREIS MLS. All data, including all measurements and calculations of area, is obtained from

various sources and has not been, and will not be, verified by broker or MLS. All information should be independently reviewed and verified for accuracy. Properties may or may not be listed by the office/agent presenting the information.

TEXAS ELITE TEAM is a licensed Agent in the state of Texas and is a leading authority on DFW Metroplex, Our love for the communities we live and work in are why we do what we do. Stop by the office and experience the Texas Elite Team way of DFW area real estate.

@ 2024 TEXAS ELITE TEAM