TRICIA MADRID

LOCAL LOAN CONSULTANT

NMLS# 2566884

Call Us!

(682) 777-3950

NMLS # 1393730

Your DFW Trusted

Lending Partner

Our primary objective is to match our homebuyers with the best program to meet their needs. Everyone is in a different place in their journey of home ownership and we understand that and meet you where you are.

TRICIA MADRID

Your Trusted Mortgage Advisor

Dear Homebuyer,

We appreciate your consideration. I look forward to receiving your feedback and addressing any questions you may have after reviewing our presentation. Our team is dedicated to serving your needs, not those of financial institutions. We prioritize open communication, starting with pre-approval guidance and continuing through to post-closure refinancing advice. Choosing to work with us means you will enjoy a transparent and confident home-buying experience.

Please take a moment to explore the presentation to see what we have to offer. I am eager to discuss further opportunities with you soon.

Best Regards,

Tricia Madrid

Meet Tricia Madrid

Tricia Madrid brings over 20 years of expertise in the mortgage industry, making her a trusted advisor for countless clients on their journey to homeownership. Her extensive experience allows her to offer tailored guidance and customized solutions for each client's unique financial needs. Throughout her career, Tricia has held numerous roles, including Licensed Loan Originator/Broker, Processor, Closer, Senior Government Underwriter, Credit Risk Specialist, and Assistant Vice President at a renowned bank.

What sets Orca apart from other Lenders

Orca Home Loans distinguishes itself from other mortgage lenders in several key ways:

Fast and efficient service: Orca Home Loans aims to complete the loan process, from application to funding, in less than 30 days. This quick turnaround can be especially beneficial for borrowers who need to close on a property quickly.

Streamlined online application: The company offers a simplified, 100% online loan application process, making it convenient for borrowers to apply and track their loan status.

Personalized guidance: Orca Home Loans provides experienced Mortgage Advisors who offer tailored guidance to help clients navigate the complexities of home financing.

Competitive rates: The company emphasizes offering competitive mortgage rates, which can potentially save borrowers money over the life of their loan

Support for loan officers: Orca Home Loans provides comprehensive operational assistance to its loan officers, allowing them to focus on generating new business while the operations team handles the details

Transparency: The company offers full transparency into each milestone of the loan process, from application to clear-to-close (CTC), keeping clients and loan officers informed throughout.

Quick problem-solving: For complex scenarios, Orca Home Loans promises to provide options on how to move forward with a client within 2 hours, rather than day.

By combining technological efficiency with personalized service and support for both borrowers and loan officers, Orca Home Loans aims to create a more streamlined and user-friendly mortgage experience.

Services Offered

We are proud of the exceptional services we provide and are dedicated to ensuring every client has the best experience possible. Here are the details about what we offer.

Whatever your unique needs, we are confident in our ability to help you reach your goals. Our clients are our top priority, and we are committed to fostering long-lasting relationships built on trust, transparency, and mutual respect.

Finding The Right Loan for You

With access to a variety of investor and loan programs, I provide my clients with substantial savings through strategic planning, expert advice, and a wealth of innovative resources. Whether you're looking to invest or refinance, you can trust that I'll find the most competitive rates available in the market.

The Path to Your First Home

As a local native, I have an in-depth understanding of the real estate and mortgage banking markets that you can truly benefit from. My commitment is to provide you with the information necessary to make well-informed decisions. Rely on my expertise to navigate you through the home-buying process with clarity and confidence.

Buying Your Next Home

Navigating the loan process alone can be daunting. That's where we come in! With years of experience, we specialize in finding the perfect loan to meet your unique needs. Our streamlined process ensures we match your needs with the best program to fit your needs. Thus securing the loan you deserve. We are committed to finding the right fit for you. Our team values transparency and honesty, making your experience as stress-free as possible. You've worked hard to get here—let us handle the rest.

Refinance

Refinancing your home is a smart move, especially with current rates at historic lows. The long-term financial benefits make it a compelling option. By strategically restructuring debt, I've helped many clients save thousands of dollars. Don't miss out on the chance to maximize your savings.

Appreciation

This graph shows the appreciation after 7 years, Consider the cumulative appreciation vs. the cost of down payment plus closing costs to acquire the home. Your return on investment generally far exceeds the cost to buy the home. This is what creates "Generational Wealth" for your family for years to come.

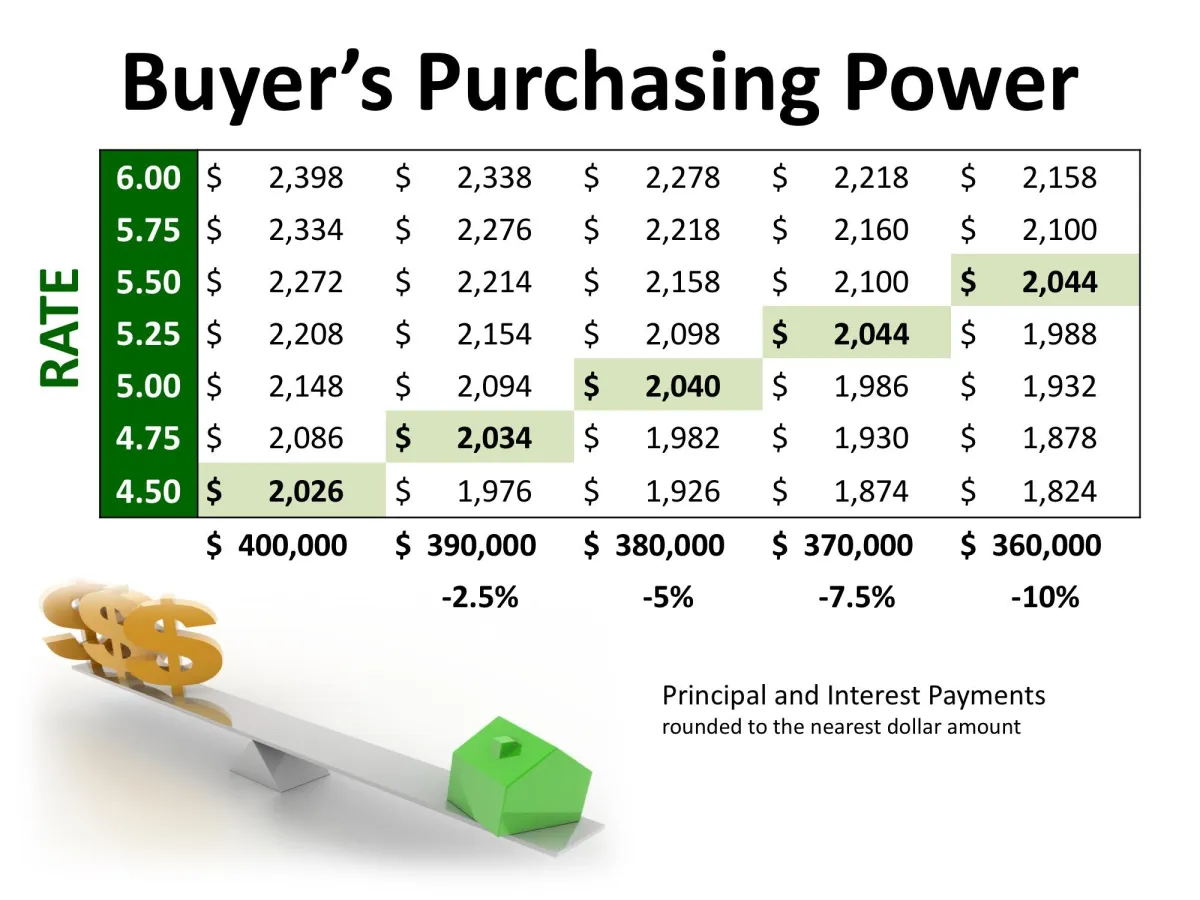

Buying Power

Fluctuating interest rates can greatly impact a buyer's purchasing power. The chart below illustrates monthly principal and interest payments based on various loan amounts and starting rates.

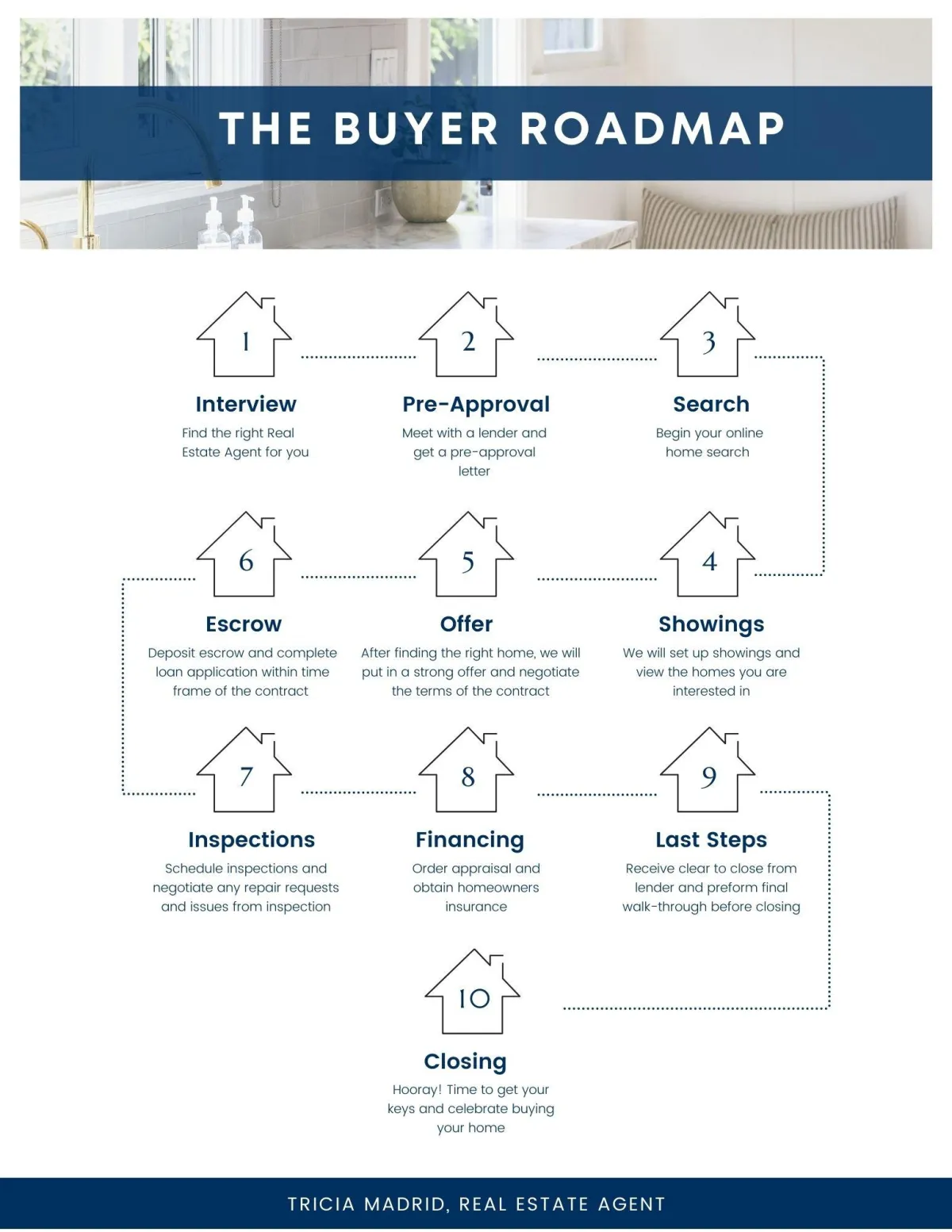

The Loan Process

Closing on a home loan can be a complex and intimidating process. our Mortgage brokerage simplifies it by removing the guesswork. Our trustworthy and experienced fiduciary broker prioritizes your best interests over those of the banks.

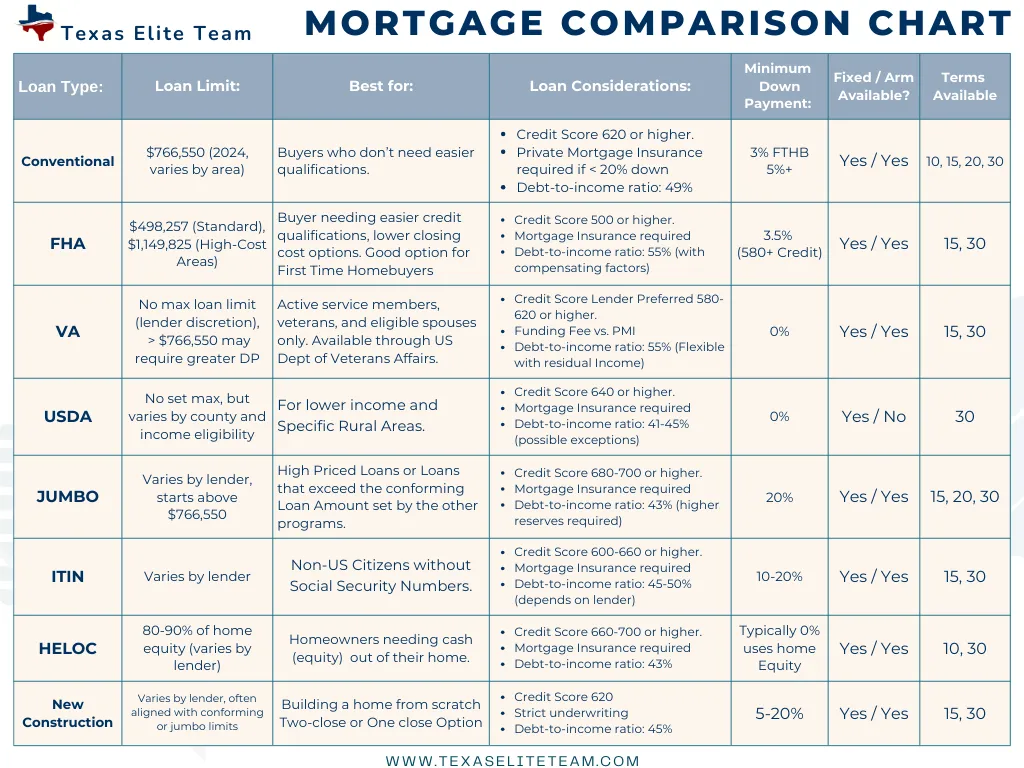

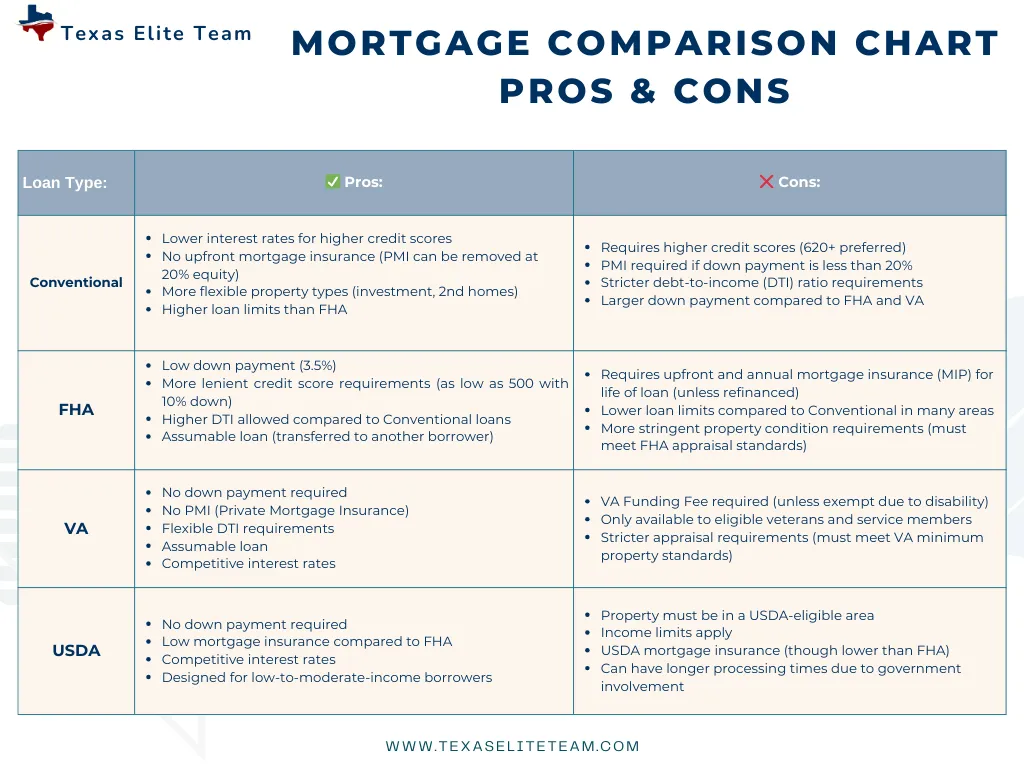

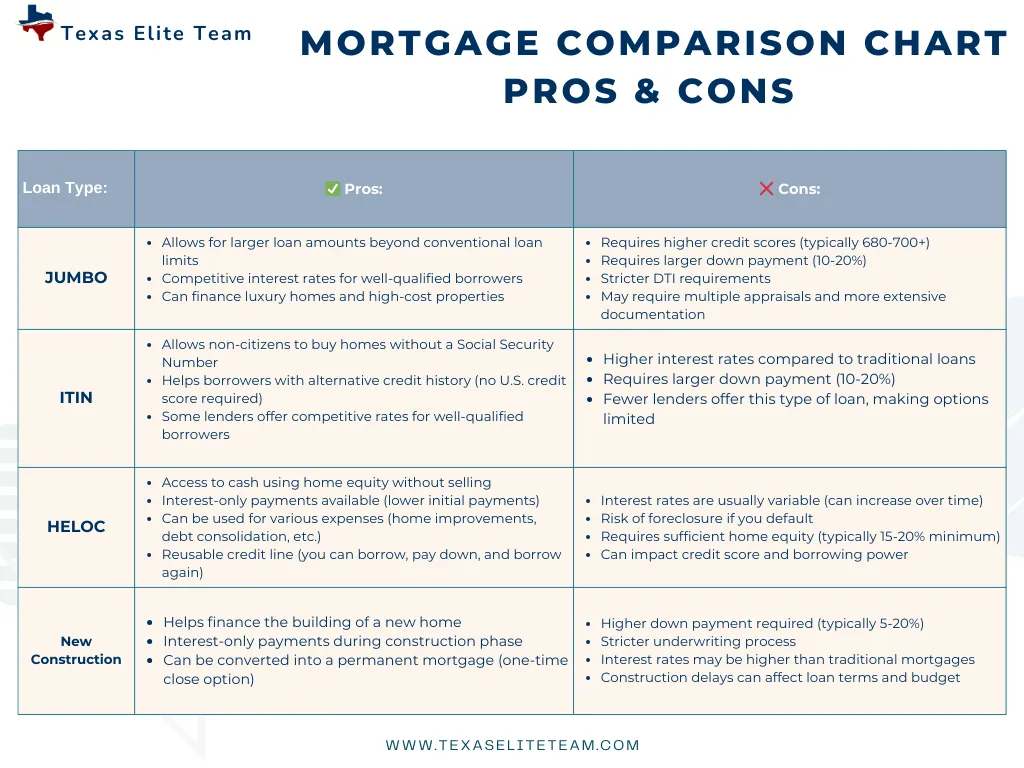

Mortgages We Offer

We finance properties including:

Single-family home

2-4 Unit properties

Townhouses

Condominiums

Planned Unit Development (PUD)

Manufactured homes (not chattel)

We offer a wide range of mortgage products to suite your needs:

FHA

VA

Conventional

USDA

Jumbo

ITIN

New Construction

Home Equity / HELOC

Bank Statement Loans

Investor Loans

Non-Owner Occupied

Non QM

Down Payment Assistance

MCC - Mortgage Credit Certificate

and more....

Recurring vs. Non-Recurring Costs

Navigating the journey of buying or refinancing a home can feel daunting, particularly when it comes to closing costs. These fees encompass a variety of terms, figures, and paperwork that can easily lead to confusion. To simplify things, we've created a handy glossary of mortgage terms for your convenience.

In this article, we'll break down the various expenses you might encounter when closing escrow or refinancing your home. Our goal is to help you prepare and steer clear of unexpected financial surprises. For clarity, we'll divide these costs into recurring and non-recurring expenses.

Click the Loan types below to learn more about each

Life Events That Could Delay Your Home Loan Closing

Several common life events and issues can delay the closing of a home loan. Understanding these potential obstacles can help you prepare and avoid unnecessary stress. Here are some of the most frequent causes:

Title Report Problems

Boundary disputes revealed during a property survey

Lender Delays such as

Problems obtaining all necessary information or documents requestedAdditional documentation requests from underwriters, such as tax transcripts or letters of explanation

Changes in the buyer's financial situation or discrepancies in the closing documents

Home Inspection Problems

Appraisal Value Discrepancies

Compliance with Regulations: Errors or discrepancies in the Closing Disclosure

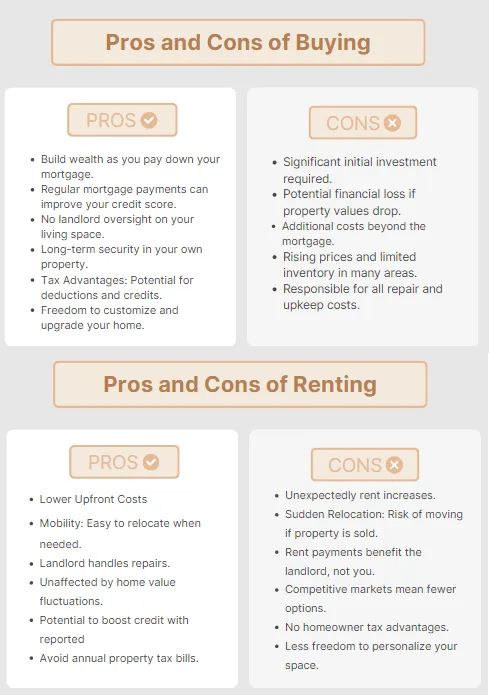

Rent vs. Buy: Which is Best?

In today's dynamic real estate market, both home values and rental costs have seen substantial increases. Are you at a crossroads, trying to decide whether to purchase a home or continue renting? This decision can significantly impact your financial future and quality of life.

Make an Informed Choice

Choosing between buying and renting isn't just about the monthly payment. It's about understanding your long-term goals, financial stability, and lifestyle preferences. Our comprehensive guide can help you navigate this crucial decision with confidence.

Let’s Get Started

Start your journey to homeownership with a simple step: complete a pre-approval application. Create your free account at The Mortgage House and kick off your home buying process today. This quick and easy application will set you on the path to finding your perfect home.

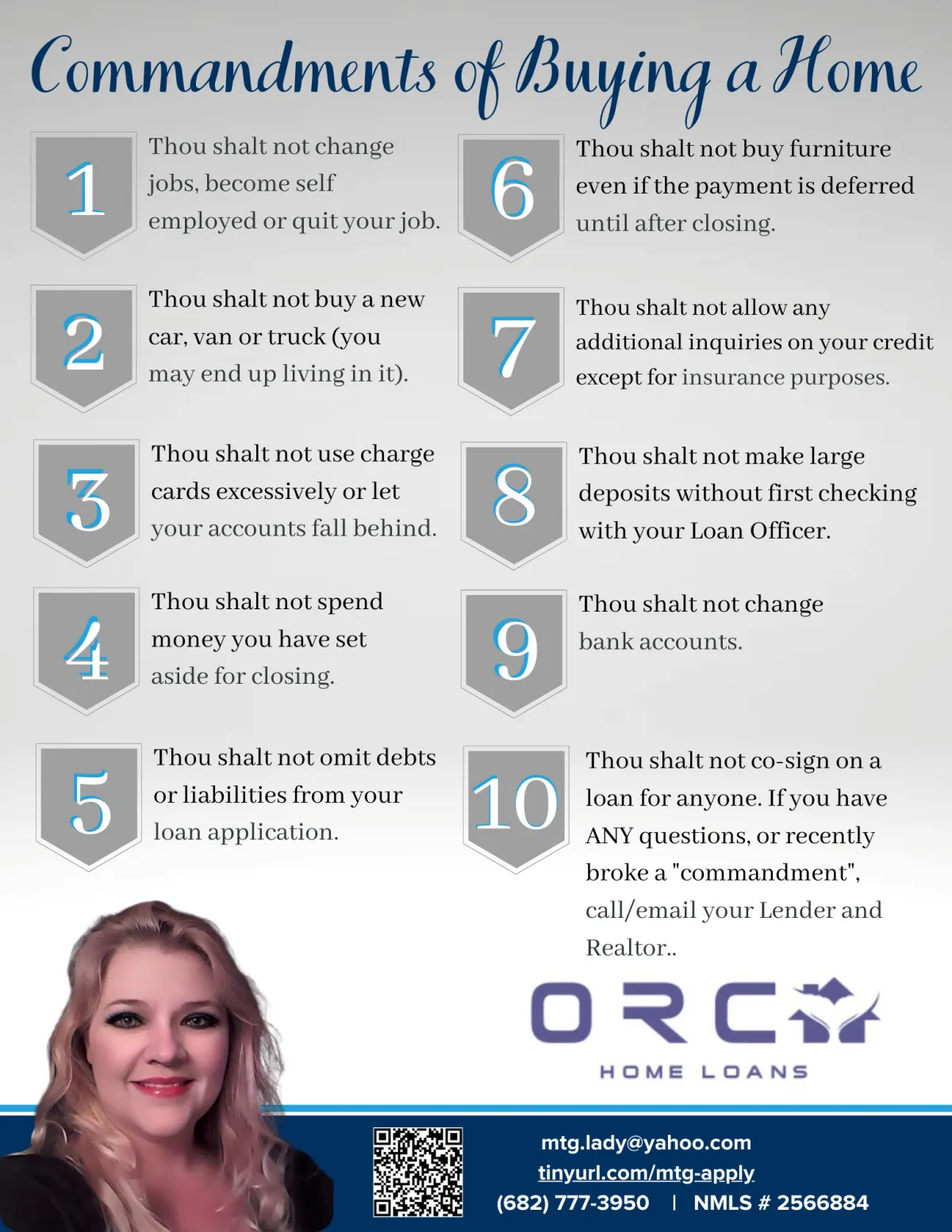

10 Commandments

Navigate your loan process smoothly by adhering to these 10 essential guidelines. Following this advice will help you sidestep common obstacles and keep your loan on track for a timely closing. Let's explore these crucial dos and don'ts to ensure a hassle-free borrowing experience.

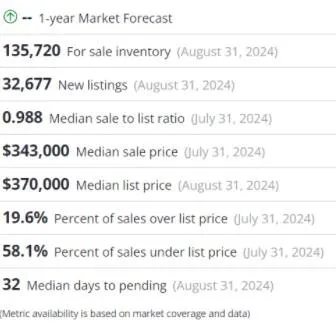

Texas Housing Market Overview

Thinking of changing jobs?

Think carefully! Lenders will verify your employment both when you get pre-approved and just before the final loan closing. Changing jobs before closing can pause or even decline your application as the Lender reassesses your job & income stability. To minimize risk, delay job changes until after you've closed on your new home if possible. If not, talk to your Loan Officer and let them know the challenges you are facing and your plans to see how those align with the purchase of your new home.

CHANGE TYPE

IMPACT ON

MORTGAGE APPROVAL

Higher income, same industry

Often positive; stable industry and higher salary can help.

Lower income

Could reduce borrowing power or lead to denial if affordability fails

Move to new industry

Risky; lenders may see this as less stable, especially with little history

Salary to hourly

May require proof of consistent hours and income; could increase scrutiny

Hourly to salary

Can be positive if the salary is steady and higher; documentation needed

Salary or hourly to self-employed

Highest risk; requires 1–2 years of stable, documented self-employment income

Self-employed to salary or hourly

Lender will want proof of employment and income but can offer more stability

Don't worry, we can help!

Immediate reporting and documentation (offer letter, verification of employment, new pay stubs) are required for any job changes before closing.

Additional documentation may be needed for any job change. Often the lender will need Verification of Employment as well as a full 30 days worth of paystubs

INCOME CONSIDERATIONS

Your lender cares most about stable, predictable income history.

An increase in salary or a promotion in the same line of work with robust documentation is generally treated favorably.

Decreased income could either be OK (if you still pass affordability tests) or problematic (if you no longer qualify for needed loan amount).

Fluctuating or less predictable income (e.g., commissions, gig work) prompts more scrutiny.

SWITCHING TO SELF-EMPLOYMENT

Expect strict requirements: generally, lenders need at least two years of tax returns showing reliable business income.

Down payment, credit score, and debt-to-income (DTI) ratio requirements remain, but documentation demands are higher.

Lenders want detailed proof your business generates enough cash flow to cover payments.

OTHER KEY CONSIDERATIONS

Lenders may request a larger down payment or offer less favorable terms if a job change introduces risk.

For joint applicants, a co-signer or spouse’s stable income can sometimes salvage approval if your own situation changes.

Lenders wlil generally get an updated Verification of Employment and ask for Most recent 30 days Paystubs showing a YTD.

This could delay closing waiting for the full 30 days of paystubs.

Always communicate proactively with your lender if contemplating or making a switch to avoid delays or surprises.

Looking at homes with Foundation Problems?

FHA LOANS

FHA will NOT close with significant structural issues

Foundation problems must be repaired prior to closing

Must pass FHA “minimum property standards”

FHA 203(k) is better (see below)

VA LOANS

Similar to FHA — property must be safe, sound, sanitary

Foundation issues must be corrected prior to funding

VA engineering certification may be required

VA buyers can use VA renovation loans in limited cases

CONV LOANS

Minor cosmetic cracks: may be acceptable

Moderate–major issues: typically require engineer’s report + repairs before closing

Sometimes a repair escrow can be used IF the lender allows it

Often best suited if the buyer is using strong reserves + high credit + large down payment

USDA LOANS

STRICT property condition requirements

Any foundation issues must typically be fixed before closing

REHAB / RENOVATION LOANS

203(k)

Allows financing of foundation repair and purchase into ONE loan

Contractor bids required

Work completed AFTER closing

Perfect for:

✔ settlement

✔ piers

✔ drainage correction

✔ slab stabilization

REHAB / RENOVATION LOANS

Conventional HomeStyle Renovation

Similar to 203(k)

Allows higher loan amounts

More flexible than FHA

Strong option for investors & second homes, whereas 203(k) is primary residence only

HARD MONEY / PRIVATE LOANS

Property condition irrelevant

Approval is based on the asset value, not borrower credit

Ideal for:

✔ flips

✔ major structural work

✔ severe foundation displacementHigher interest + shorter terms (6–24 months)

CASH PURCHASE

Still the fastest way to close when foundation problems are severe

Often used by:

✔ investors

✔ landlords

✔ renovation buyers

FOUNDATION MATRIX

If you can insert a quarter or more into a block/mortar crack — that is no longer a hairline or cosmetic issue. That crack is large enough to signal meaningful displacement or movement of the wall. At that stage, you should call a licensed foundation contractor or structural engineer to evaluate the condition and discuss repair options.

Small hairline mortar cracks do occur naturally as homes age and settle — but anything wider than 1/8 inch should be treated as a structural concern rather than a cosmetic flaw.

If the crack remains hairline and unchanged — and can’t fit a quarter — most lenders consider it minor. If the crack shows signs of growth or displacement, a structural engineer’s report confirming it’s non-structural is often enough to keep financing moving forward.

REMEMBER...I AM NOT A HOME INSPECTOR OR FOUNDATION EXPERT!! This information was gathered from my research and should be confirmed by a Foundation Expert.

Conventional Loans: Typically approved with no issue if the crack is hairline and not actively expanding. If the appraiser notes concern, they may require sealing as a precaution.

FHA Loans: Allowed if the crack is narrow and poses no structural risk. FHA may require the crack to be sealed with epoxy if moisture intrusion is present.

VA Loans: Acceptable if the crack does not compromise structural soundness. A dry, hairline diagonal crack is usually not a problem for VA underwriting.

USDA Loans: Permitted if the foundation is stable and there’s no evidence of shifting or settlement.

Renovation Loans (FHA 203k, Homestyle): A good option if you want the crack proactively repaired — the repair cost can be wrapped into the mortgage.

Hairline shrinkage cracks

FINANCING TYPE: Conventional, FHA, VA

Hairline cracks are very common in new construction and usually appear within the first year as the foundation settles and cures. These cracks are typically cosmetic and can be repaired by a homeowner for around $200 or professionally for $400–$600.

If your home is still under builder warranty, notify your builder immediately and document the crack with photos. Repairs for hairline cracks are often covered, and tracking progression helps ensure proper resolution.

Minor settling

FINANCING TYPE: Conventional, FHA

Minor Settling occurs naturally as a home adjusts to its site over time. It’s the most common cause of small foundation imperfections and is considered normal in virtually all houses, especially within the first few years after construction. Minor settling may result in thin, vertical or diagonal hairline cracks or slight interior cosmetic changes like tiny drywall seams or minor floor unevenness.

These signs are typically cosmetic and stabilize as the home completes its settling process.

If cracks remain thin, unchanged, and dry — and doors or windows are not sticking — the settling is likely minor. Photograph and date the cracks for reference, and simply monitor over time. If progression or widening occurs, consult a foundation professional for evaluation.

Horizontal cracks

FINANCING TYPE: Probably requires engineer report

Conventional Loans: Often require a structural engineer’s report and proof of repair. If there’s inward bowing or active shifting, financing may be denied until repairs are completed.

FHA Loans: FHA requires the foundation to be structurally sound. Horizontal cracks will typically trigger a required inspection by an engineer or licensed foundation specialist.

VA Loans: VA is strict on structural safety — horizontal cracks almost always require engineering certification or repair prior to closing.

USDA Loans: Similar to FHA — must verify structural integrity. Horizontal cracks are not considered cosmetic.

Renovation Loans (FHA 203k / Homestyle): These are ideal — you can include foundation repair costs into the loan so the property is repaired post-closing.

Horizontal foundation cracks are serious and often caused by excess soil pressure or hydrostatic water pushing against the wall. These cracks may appear with inward bowing or moisture intrusion and can occur in both poured and block foundations.

In colder climates, horizontal cracks frequently develop below grade due to freeze–thaw cycles, which place increasing lateral pressure on the foundation wall over time.

Consult multiple foundation specialists promptly to assess the issue and repair options. The good news—horizontal cracks can often be permanently repaired, with lifetime and transferable warranties available.

Stair Step cracks

FINANCING TYPE: Conventional, FHA, VA, USDA, Renovation Loans (FHA 203k, Homestyle)

Conventional Loans: Approval is possible if the crack is narrow, stable, and cosmetic only. If there is evidence of displacement or widening, the lender may require repair or further inspection.

FHA Loans: FHA may require a structural engineer’s evaluation if a stair-step crack shows any sign of movement, moisture, or misalignment between blocks. Repairs may also be required.

VA Loans: VA typically requires the foundation to be fully sound. If stair-step cracks reflect settlement or shifting, an engineering certification will likely be required.

USDA Loans: Similar to FHA — allowed only if cracks are cosmetic. Structural concerns will trigger inspection requirements.

Renovation Loans (203k / Homestyle): Excellent option — if repairs are needed, the foundation repair cost can be wrapped into the mortgage.

Block foundations are particularly vulnerable to stair-step cracking, where cracks form along the mortar joints between blocks in a zig-zag pattern. These cracks are not merely cosmetic — they may indicate underlying structural stress that can jeopardize the stability and safety of the foundation.

Common Causes of Stair-Step Cracks:

1. Foundation settlement or sinking in one portion of the home

Uneven soil compression or shifting causes one side of the structure to drop, resulting in stress fractures that form a stair-step pattern.

2. Moisture-related issues around the exterior

Poor drainage, clogged gutters, improper grading, or hydrostatic pressure can force moisture against the wall. Over time, this exacerbates mortar deterioration and contributes to cracking.

Vertical cracks

FINANCING TYPE: Conventional, FHA, VA, USDA, Renovation Loans (FHA 203k, Homestyle)

Conventional Loans: Usually approved with no condition, especially if the crack is thin and stable. The appraiser may simply note it for observation.

FHA Loans: Allowed if the crack is narrow and non-structural. FHA may require sealing to prevent moisture, but typically does not require structural repair.

VA Loans: Permitted as long as the crack does not indicate foundation instability. VA looks primarily for moisture problems or widening.

USDA Loans: Acceptable if the crack is cosmetic and the foundation is otherwise intact.

Renovation Loans (FHA 203k, Homestyle): Ideal if the buyer wants the crack professionally sealed or injected as part of closing, with costs financed into the loan.

Vertical foundation cracks are typically less concerning than horizontal ones and usually don’t indicate a structural problem. They’re common in poured concrete walls and often result from natural settling or the concrete curing process over time.

These cracks are generally repaired using epoxy or polyurethane injections. DIY kits start around $75, while professional repairs usually begin around $400.

If there’s no moisture present and the crack is too narrow to fit a quarter into, it’s generally not urgent. Document it with photos and monitor, or repair with an epoxy injection if desired.

Diagonal cracks

FINANCING TYPE: Conventional, FHA, VA, USDA, Renovation Loans (FHA 203k, Homestyle)

Conventional Loans: Typically approved with no issue if the crack is hairline and not actively expanding. If the appraiser notes concern, they may require sealing as a precaution.

FHA Loans: Allowed if the crack is narrow and poses no structural risk. FHA may require the crack to be sealed with epoxy if moisture intrusion is present.

VA Loans: Acceptable if the crack does not compromise structural soundness. A dry, hairline diagonal crack is usually not a problem for VA underwriting.

USDA Loans: Permitted if the foundation is stable and there’s no evidence of shifting or settlement.

Renovation Loans (FHA 203k, Homestyle): A good option if you want the crack proactively repaired — the repair cost can be wrapped into the mortgage.

Diagonal cracks, like vertical ones, are generally not structurally serious. They typically run up to 30 degrees off vertical and are usually caused by natural concrete curing or gradual settling over time. These cracks are commonly repaired using epoxy injections, with costs ranging from about $75 for DIY kits to $400+ for professional repair.

When you find a diagonal crack, take a photo and note the date. If it’s a hairline crack and a quarter can’t fit inside, there’s no immediate concern. Re-check in about six months, and if the crack has grown, contact a foundation specialist for evaluation.

Shrinkage cracks

FINANCING TYPE: Conventional, FHA, VA, UDSA, FHA 203k, FNMA Homestyle

Conventional Loans: Usually approved with no issue as long as the appraiser confirms the crack is cosmetic. Minor crack sealing may be recommended but not required.

FHA Loans: Allowed if the crack is non-structural, hairline sized, and dry. FHA may request that the crack be sealed or monitored, but typically does not require structural repair.

VA Loans: Allowed if the crack does not compromise foundation integrity or function. If there is no settlement, moisture, or displacement, VA will generally approve the property.

USDA Loans: Also acceptable if the crack is cosmetic and dry. USDA follows similar guidelines to FHA, prioritizing safety and habitability.

Renovation Loans (FHA 203k, Fannie Mae Homestyle): A great option if the buyer wants the crack professionally epoxied or sealed as part of closing — the repair cost can be built into the loan.

Shrinkage cracks form as poured concrete dries and loses moisture, especially within the first year of a new build. These are typically vertical cracks and are generally not structural concerns. The primary issue is potential radon entry if you’re in an area with elevated radon levels.

If your home is under builder warranty, report the crack to your builder — shrinkage cracks are often covered. Otherwise, take photos and document the crack. If it expands or additional cracks form, consider an epoxy injection repair.

Active shifting

FINANCING TYPE: Repair or 203(k) required

Active Shifting refers to ongoing movement of the foundation caused by unstable soil conditions beneath or around the home. Unlike cosmetic cracking, active shifting continues over time, and signs typically worsen if not addressed. Common causes include:

Expansive or Clay-Heavy Soil: Soil that swells when wet and shrinks when dry, pushing and pulling the foundation.

Poor Drainage or Water Saturation: Excess water softens soil, reducing support and creating movement beneath the slab or walls.

Tree Root Interference: Large roots drawing water from the soil can create voids and uneven settlement.

Improper Backfill or Soil Compaction: If soil wasn’t compacted correctly during construction, the foundation may shift as it settles.

Signs of active shifting include widening cracks, new cracks appearing over time, slanted floors, doors sticking, or gaps forming between walls and ceilings. If you notice progression—not just a static crack—call a structural foundation expert immediately. Active shifting needs prompt evaluation to prevent long-term structural damage.

Major slab displacement

FINANCING TYPE: Hard money or 203(k) prior to conventional refinance

Poured concrete slabs commonly develop cracks as they age, and the cause determines the severity. Here are the three most common reasons:

Concrete Curing: The natural drying and settling of the slab — typically cosmetic and not structural.

Slab Settlement: Indicates a potential serious issue, often due to poorly compacted soil or improper preparation. This requires professional evaluation.

Frost Heave: In colder climates, moisture beneath the slab can freeze, expand, and cause the concrete to lift or crack.

If the crack is wider than a hairline, consult a foundation specialist to determine the cause and best repair options.

Failed pier & beam

FINANCING TYPE: Repair + engineer certification

Failed Pier & Beam issues occur when the piers, posts, or beams supporting the home weaken, rot, shift, or collapse. Unlike slab foundations, pier-and-beam systems rely on multiple support points — if one or more start to fail, stress is distributed unevenly and structural movement can result. Common causes include:

Wood Rot or Termite Damage: Moisture or pests weaken support beams and joists.

Pier Movement or Settlement: Shifting soil can cause a pier to sink or tilt, reducing vertical support.

Improper Spacing or Installation: Inadequate or poorly installed supports may not bear the home’s structural load.

Moisture & Drainage Issues: Water intrusion under the house accelerates deterioration and movement.

Warning signs include sagging or sloping floors, bouncing or soft spots when walking, wall cracks near windows or door frames, or doors that suddenly stick. If you observe these symptoms, have a foundation professional or structural engineer evaluate the pier-and-beam system promptly — repairs may involve re-leveling, adding support piers, or replacing damaged beams and joists.

Water intrusion / Non-Structural

FINANCING TYPE: Must be resolved for virtually all financing

A non-structural foundation crack usually doesn’t affect the home’s structural integrity. It’s commonly just a cosmetic crack that may allow water to seep in during heavy rain or snowmelt. Even though the structure isn’t at risk, moisture intrusion can damage walls, flooring, personal items, and create conditions for mold — and cracks can worsen over time if ignored.

Small vertical or diagonal cracks (about 1–2mm) in concrete basement walls often result from normal curing and are typically non-structural — but should still be monitored and sealed to prevent moisture.

Things to watch for that might indicate Foundation Issues

Cracks in Drywall or Plaster

Separation Between Walls and Window or Door Frames

Noticeable Uneven or Sinking Areas

Counters, Cabinets, or Other Static Structures Separating From the Wall

Cracked or Leaning Chimney

Interior Wall and Floor Cracks

Nails Popping Out of Drywall

Warped Floors or Ceilings

Persistent Musty or Moldy Odors

Bowing, Leaning, or Uneven Walls

Client Testimonials

Curious about our reputation? Discover what our clients have to say about their experience with us. Click here to read authentic testimonials and reviews from homeowners we've helped along their journey.

“Her commitment to ensuring my understanding and confidence in this process has made this journey both informative and rewarding.”

Tricia embodies qualities that truly stand out - her expertise, unwavering patience, and professionalism. As a first-time home buyer navigating uncharted territory, I found myself relatively inexperienced in the process. Tricia stepped in, dedicating her time to meticulously guide me through every aspect, ensuring I grasped the nuances involved. Her responsiveness was remarkable - whenever I expressed interest in a property, her swift reply of "I will get that set up!" was reassuring.

Her flexibility in accommodating viewing schedules and her constant availability for my inquiries made the journey smoother. Tricia didn't merely showcase homes; she delved into thorough explanations, shedding light on intricate details and potential risks associated with each property. Her transparency and honesty were invaluable, earning my deep appreciation.

Tricia's unwavering dedication to helping me discover the perfect home has been evident throughout our interactions. Her commitment to ensuring my understanding and confidence in this process has made this journey both informative and rewarding. I am positive that I will find my dream home with the help of Tricia!

La Tonya W – January 2024

“She was very nice she went above and beyond working with me to get me a home that is within my needs”

She was very nice she went above and beyond working with me to get me a home that is within my needs and my children. I wanted to stayed with the HEB area and we look for about I lost count but she never gave up. Tricia is very kind and patience explaining being a homeowner since this was my first home

~ Josephine Dankwa

TEXAS ELITE TEAM

Texas Elite Team

4314 Blossom Valley Lane

Richmond, TX 77469

Phone: (682) 777-3950

Email us!

Like Us

MLS Information Deemed Reliable But Not Guaranteed. This information is being provided by the NTREIS MLS. All data, including all measurements and calculations of area, is obtained from

various sources and has not been, and will not be, verified by broker or MLS. All information should be independently reviewed and verified for accuracy. Properties may or may not be listed by the office/agent presenting the information.

TEXAS ELITE TEAMis a licensed Agent in the state of Texas and is a leading authority on DFW Metroplex, Our love for the communities we live and work in are why we do what we do. Stop by the office and experience the Texas Elite Team way of DFW area real estate.

Call Us!

(682) 777-3950

Sell Your House

How It Works

Contact Us

Blog

Hud Homes

Good Neighbor Next Door Program

FREE Home Value Analysis

Buy A House

Our Company

Privacy Policy

Prevent Foreclosure

© 2024 TEXAS ELITE TEAM

Facebook

Instagram

X

LinkedIn

Youtube

TikTok

Pinterest

Website